Colorado State University hurricane researchers are predicting a slightly below-average Atlantic hurricane season in

Life Insurance FAQs

[ Auto Insurance | Life Insurance | Home Owners Insurance | Business Insurance ]

- Do you have debt?

- Why buy life insurance?

- How much life insurance do I need?

- Are there different types of policies?

- What is a beneficiary?

- How often should I review my policy?

- Life Insurance – Instant Quote

GOT DEBT!

The average American will have $2,000,000 go thru their hands over their lifetime, but will only have an average of $60,000 of assets at age 65.

THAT’S NOT THE AMERICAN DREAM!

Source: US Census

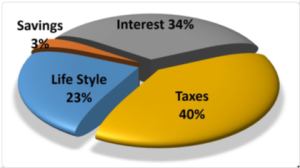

For every dollar that we make, 34 cents of that dollar goes toward interest. That’s your mortgage, credit cards, cars, etc.. 40 cents goes to taxes, not just income tax, also property tax, gas tax, have you every looked at the taxes on your cell phone bill? So we live on 23 cents of every dollar that we make. Your Family Bank® shows you how to reduce the amount of interest and taxes that you pay, so you can increase the amount you can save and enjoy.

What if I could show you how to be completely out of debt in 9 years or less, including your mortgage, without spending any more money than you are already spending.

For more information, please contact

Bonnie Botfeld, Insurance Specialist

Office: 954-510-7177; Fax: 866-238-5255

Email: bonnie@yourfloridainsurance.

Website: www.yourfloridainsurance.com

Many financial experts consider life insurance to be the cornerstone of sound

financial planning. It is generally a cost-effective way to provide for your

loved ones after you are gone. It can be an important tool in the following

ways:

1. Income replacement

For most people, their key economic asset is their ability to earn a living. If

you have dependents, then you need to consider what would happen to them if

they no longer have your income to rely on. Proceeds from a life insurance

policy can help supplement retirement income. This can be especially useful if

the benefits of your surviving spouse or domestic partner will be reduced after

your death.

2. Pay outstanding debts and long-term obligations

Consider life insurance so that your loved ones have the money to offset burial

costs, credit card debts and medical expenses not covered by health insurance.

In addition, life insurance can be used to pay off the mortgage, supplement

retirement savings and help pay college tuition.

3. Estate planning

The proceeds of a life insurance policy can be structured to pay estate taxes

so that your heirs will not have to liquidate other assets.

4. Charitable contributions

If you have a favorite charity, you can designate some of the proceeds from

your life insurance to go to this organization.

How much life insurance do I need?

To decide how much life insurance to buy, you need to first figure out what

your goals are in purchasing this coverage. Ask yourself the following:

- Do I want to spare my loved ones funeral costs and outstanding debts?

- Am I concerned that my spouse or domestic partner will not be able to continue to

pay off the mortgage if I die suddenly? - Do I have dependents who count on my income?

- Am I concerned about college savings for my children or retirement savings for my

spouse if I die suddenly?

While all situations are different, here are two scenarios to help you think

through the questions you should pose to your insurance professional:

Dependents

If you have children, a spouse who does not work outside the home or aging

parents who you financially support, you have dependents. Alternatively, you

may simply have a spouse or domestic partner who would be unable to pay the

mortgage without your financial contribution. In either case, your loved ones

will no longer have your income to help them pay the bills and maintain their

lifestyle after you are gone. You will have to purchase enough insurance to

provide for their future, while considering how much of your budget should be

devoted to life insurance.

Some insurance experts suggest that you purchase five to eight times your

current income. While this may be a good way to begin estimating your family?s

needs, you will also need to figure how much your dependents will need to pay

for some or all the following:

- Cost of owning a home (mortgage, maintenance, insurance, taxes and utilities)

- College savings

- Food, clothing, utilities

- Child care

- Nursing home or elder care

- Retirement savings

- Funeral expenses and estate taxes

Your family may also need extra money to make some changes after you die. They

may want to relocate or your spouse may need to go back to school to be in a

better position to help support the family.

No dependents

If you are young and plan to have a family in the future, you may also want to

consider purchasing life insurance now so that you can lock in a good rate.

Just because you don?t have dependents, does not mean you don?t have

responsibilities. For instance, you may be concerned with not being an economic

burden to others if you die unexpectedly. You may also want to leave some money

behind to close family, friends or a special charity as a remembrance. In this

case, you should purchase enough coverage to pay funeral and burial expenses,

outstanding debts and tax liabilities, so that the bulk of your estate goes to

your family, friends or charities.

Your insurance needs will vary greatly according to your financial assets and

liabilities, income potential and level of expenses.

Are there different types of life insurance?

While there a many different types of life insurance policies, they generally

fall into two categories ? term and permanent.

Term

Term Insurance is the simplest form of life insurance. It provides financial

protection for a specific time, usually from one to 30 years. These policies

are relatively inexpensive and are well suited for goals, such as insurance

protection during the child-raising years or while paying off a mortgage. They

provide a death benefit, but do not offer cash savings.

Purchasing term insurance is like renting a home. It is a short-term solution.

Monthly costs are usually lower, but you will not be building equity. Just as

many people rent (while saving to buy a home), individuals who need insurance

protection now, but have limited resources, may purchase term coverage and then

switch to permanent protection. Others may view term insurance as a

cost-effective way to protect their family and still have money to put into

other investments.

Permanent

Permanent insurance (such as universal life, variable universal life and whole

life) provides long-term financial protection. These policies include both a

death benefit and, in some cases, cash savings. Because of the savings element,

premiums tend to be higher. This type of insurance is good for long-range

financial goals.

Purchasing permanent insurance is like buying a home instead of renting. You

are taking care of long-term housing needs with a long-term solution. Your

monthly costs may be higher than if you rent, but your payments will build

equity over time. If you purchase permanent insurance, your premiums will pay a

death benefit and may also build cash value that can be accessed in the future.

A beneficiary is the person or financial institution, (a trust fund, for

instance) you name in a life insurance policy to receive the proceeds. In

addition to naming a specific beneficiary, you should name a second or

“contingent” beneficiary, in case you outlive the first beneficiary.

If there is no living beneficiary, the proceeds will go to your estate. If

there are probate proceedings this could possible delay your loved ones

receiving the money. The proceeds may also be subject to estate taxes.

Picking a beneficiary, and keeping that choice up-to-date, are important parts

of purchasing life insurance. The birth or adoption of a child, marriage or

divorce can affect your initial choice of who will receive the death benefit

when you die. Review your beneficiary designation as new situations arise to

make sure your choice is still appropriate.

Pay special attention to the wording of your beneficiary designations to ensure

that the right person receives the proceeds of your estate. If you write

“wife/husband of the insured” without using a specific name, an ex-spouse could

receive the proceeds. On the other hand, if you have named specific children,

any later-born or adopted children will not receive the proceeds – – unless the

beneficiary designation is changed.

How often should I review my policy?

You should review all of your insurance needs at least once a year. If you have

a major life change, you should contact your insurance agent or company

representative. The change in your life may have a significant impact on your

insurance needs. Life changes may include:

- Marriage or divorce

- A child or grandchild who is born or adopted

- Significant changes in your health or that of your spouse/domestic partner

- Taking on the financial responsibility of an aging parent

- Purchasing a new home

- Refinancing your home

- Coming into an inheritance